An Introduction to Art Investment

Top tips and useful information from the experts at Woodbury House

There are many ways to invest money, one being art - an asset with a unique character. In contrast to the financial market, the art market has demonstrated resilience and significant growth in the last four decades and has emerged as a new financial asset class alongside traditional asset classes such as bonds, equities or real estate and gold.

Investing in art has become one of the most significant investment trends of our time and many now consider it as a superior option to commodities such as stocks and shares, collectables and precious items.

The art market can be daunting and discouraging to the inexperienced art investor though â it is highly fluid, subjective and heavily influenced by market variables and trends. On the other hand, few markets can weather a financial storm quite like the art market and, if purchased shrewdly, a piece of artwork can be a lucrative investment. In commercial terms, it is the contemporary art market that has seen the greatest growth in the past 20 years, with a 2,100% increase.

This article has been written together with the team at Woodbury House who we had the pleasure to meet at a private exhibition at the Owners Club in the Puente Romano hotel. They hope to inform, educate and inspire some of our readers to venture into the world of Art both as a passion and a solid investment.

So, to buy or not to buy? That is the question!

There are some golden rules to keep in mind when buying. Be aware that art is a long-term investment rather than a quick flip, and always buy from trusted sources. Much depends on the reputation of the artist, so do your research!For example, ask yourself some of the following:

1. What makes the artist unique?

2. Check the track record for sales and what shows they have done; any awards or recognition they have received.

3. Are any of their pieces included in important collections or purchased by celebrity collectors?

4. Is there an interesting story or provenance behind the piece?

âBe clear on your investment goals and keep up-to-date with art market news and performance. Keep your fingers on the pulse and look out for emerging talent as this could represent a wise investment in years to come. Characteristics of good art are authenticity, originality and craftsmanship;

What kind of art to buy?

Street art is a good place to begin. A far cry from its 1970s origins of graffiti and illegal vandalism, it is now a multi-million-dollar market. Its undeniable cachet attracts an increasingly solid collector base looking to purchase the most cutting edge and experimental works of our time, and the last few years have seen an explosion in the value of street artworks. As well as the blue-chip names such as Banksy, RETNA or KAWS, there is a wealth of popular artists that will yield a strong return on investment.To give an example...

Richard Hambleton

Credited with starting the New York street art movement alongside Jean-Michel Basquiat and Keith Haring, Hambleton was a key influencer for the likes of Blek Le Rat and Banksy, who cited him as the inspiration for taking up his stencils and spray paints. In the 1980s Hambleton was the shining star of the street art movement, twice winning the Venice Biennale and appearing on the cover of Time Magazine. By the mid-1980s his work was outselling that of Basquiat and Haring,

so why the disparity in the value of their work today?

Steven Sulley, a leading expert in Hambleton, is the Founder of London-based private art studio and art advisory, Woodbury House, consultants and exclusive distributors to the Richard Hambleton Archive. He says:

âOnce an artist dies, their archive of work is naturally limited, even more so if they die young. Basquiat was just 27 when he died in 1988; Haring died at 31 in 1990. In the decades that followed, Richard Hambleton was the only one of the three who was still alive; hence his work went largely unnoticed by investors while those of Basquiat and Haring soared in value.â

In 2017, Basquiatâs 1982 âUntitledâ painting of a skull was sold at Sothebyâs for $110.5 million to become the sixth most expensive work ever sold at auction. That same year, Keith Haringâs âUntitledâ, painted in 1982, smashed its $6 million estimate at Sothebyâs in New York. Hambleton died in 2017, shortly after the release of the acclaimed âShadowmanââ film that had brought him back into the public spotlight just a few months earlier. His death sparked renewed interest in the âelusive geniusâ and his work has become keenly sought after by investors. Within months, the price of his paintings went from thousands to hundreds of thousands; in June 2018, his âAs the World Burnsâ was sold at Artcurial for $553,332.

His auction sales have spiked in recent years; in 2019, âDouble Jumpers (1999)â sold at Sothebyâs for $312,500 which was 212.5% above its estimate and in the same year, âOpening (1983)â sold for $225,000 at Phillipâs auction house for 275% over the estimate. Not bad going considering both original works were purchased in the mid-noughties for less than $10,000 respectively!! Hambletonâs artwork has increased in value at a significantly faster rate than that of Basquiat and Haring and is continuing to do so, so much so that predictions are that it will surpass them in the future.

For art lovers, investing in art seems to be a win-win situation: you can display and appreciate your artwork while it goes up in value. However, art market pundits will always advise buying what you love rather than speculating on a profit. That said, the most advisable thing to do is seek the expert advice of a trusted team of art investment consultants if you want to start to dip your toes into this approach to investments. Woodbury House supply eager investors with access to investment-grade art as well as highly knowledgeable advice on portfolio management. The team also provide its clients with a complete range of premium services including framing, delivery, hanging, storage, and more. This takes any hassle out of the process and allows investors to enjoy their acquisition.

Lauren Barker, Head of Operations at Woodbury House says:

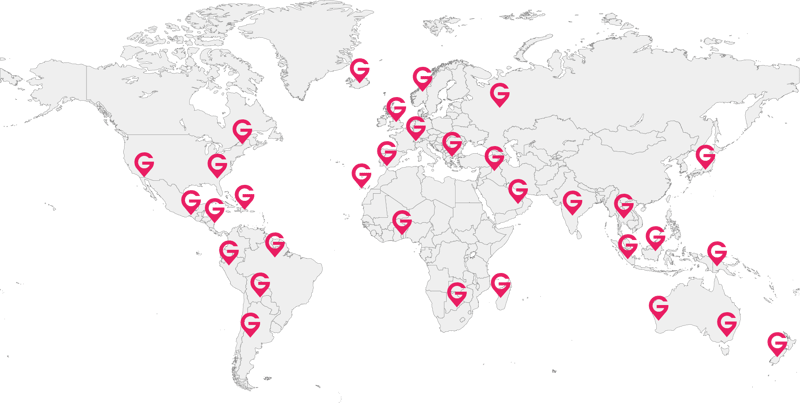

âInvesting in art is not for the faint-hearted and can be a daunting task, not least if you get it wrong. You cannot afford the luxury of buying with your heart and need to choose with a collectorâs eye, but an investorâs mind. At Woodbury House we advise those who are venturing into the art world for the first time as well as seasoned investors and help our clients navigate the global art market, in which every asset is unique and its landscape ever-evolving. I always recommend you start by having a conversation with an expert and take it from there. We offer a complimentary private art consultation service where we discuss the investment goals, budget, current market trends, and much more.â

2020 was a year of hardships around the world, not least of which was the fact that all cultural institutions across the world had to shut down for months on end. Save for the valiant efforts of museums, theatres, operas, musicians, creators and curators to offer us a digital window into their work â the world has not been able to physically enjoy the joys of cultural immersion for some time. However, Woodbury House sought to buck the trend and, adhering to strict government guidelines, staged an exhibition of Richard Hambletonâs works at Londonâs iconic Saatchi Gallery. âNightlifeâ featured a series of paintings by Richard Hambleton and photographs by Franc Palaia. The showcase brought together rare works on paper by Hambleton and images by Palaia, who documented the artistâs ephemeral work in situ, throughout the 1980s and most certainly demonstrated serious acclaim for Woodbury House.

About Woodbury House

Woodbury House is not your usual gallery. They are a private art studio and modern-day Art House offering top-class advice on art investment, which affords them an advantage as the artwork is obtained for competitive prices in comparison to their competitors who may have far larger overheads due to gallery premises, etc. The dynamic team, all of whom have extensive knowledge within the art world, work tirelessly to leverage their extensive networks to deliver consistent results for their clients. As a client, you also have the peace of mind of being in direct contact with the founders and partners.For further information visit www.woodburyhouseart.com or to book a private

consultation with the team at Woodbury House, email info@woodburyhouseart.com